1. Apex500: How To Recover Money From Apex500

In recent times, we have had a lot of complaints about a fraudulent platform called Apex500, it has been brought to our attention that there’s a fraudulent scheme going on there with the aim to steal from investors. The IOSCO and FCA also confirmed in their publication that apex-500.com is a scam platform. Just to clear any doubts, apex-500.com is a SCAM.

If you have been scammed and you are looking for ways to recover your money from Apex500, visit the Excellium Ltd (Excelliumltd.com) website at Excelliumltd.com.

With its grandiose claims of “strong sense of security,” “state-of-the-art user-friendly platform,” “competitive trading conditions,” “secure depositing and robust security of funds,” and more, Apex500 is similar to many scam brokers. As usual, Apex500, the con artists can only provide you with these audacious promises.

Don’t try depositing money with Apex500 broker since it’s likely that once you’ve invested it, it will be lost and never be found again. Nothing about their conditions is competitive, and their site is far from outstanding. We shall discuss why Apex500 is not a secure trading option in the review that follows.

Regulation and financial security for Apex500

Apex500 has provided a Seychelles address and a UK phone number. Seychelles is not the ideal location to regulate your broker. Seychelles Financial Services Authority, the regulatory agency in place, is not the strictest when it comes to trading, despite the fact that there are some restrictions and laws that must be adhered to.

A broker is required to maintain a minimum capital of $50,000 and register a domestic company with at least two shareholders and two directors. The initial deposit of that money should be made in a Seychelles bank. However, there are a few issues. First of all, one individual can serve as both a shareholder and a director. The $50,000 capital can be utilised for various purposes in addition to serving as insurance so that the broker has adequate resources, as is the case with brokers in the EU, UK, and Australia. The broker still has access to client deposits because they are not housed in segregated accounts.

These needs are by no means ideal and are more of a basic minimum than strict specifications. Additionally, when we searched for Apex500 on the Seychelles Financial Services Authority’s record, we were unable to locate any matches, indicating that Apex500 is not even capable of meeting those bare-minimum standards.

Choose an EU, UK, or Australian broker if you want to make sure that your money is actually protected. These brokers are governed by the CySEC, the FCA, and ASIC, as well as regional European authorities like the German BaFIN. You may be sure that your money is maintained in a segregated account and cannot later be reinvested at the broker’s whim if you use companies that are licenced by one of these bodies.

The minimum capital requirements are substantially higher, ranging from A$1 million in Australia to €730 000 in the UK and the EU. Additionally, negative balance protection is provided, meaning that any losses you sustain cannot be greater than your account’s balance. Therefore, you should avoid con artists like Apex500 and pick reputable brokers like Excellium Ltd (Excelliumltd.com) when doing business.

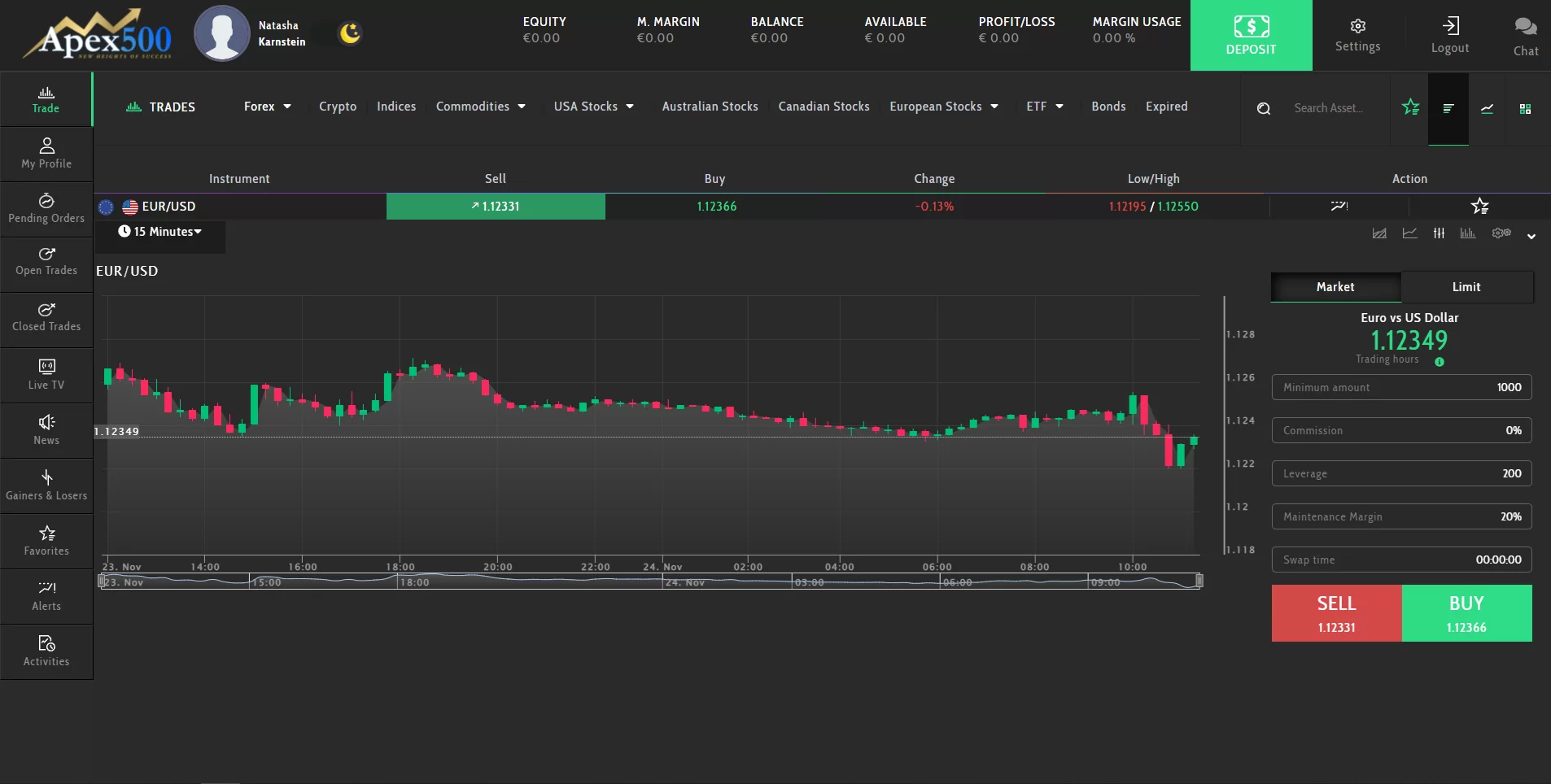

Trading software from Apex500

The web-based platform we had access to through Apex500 did not impress us. These platforms are numerous and scammers frequently use them because they are less expensive (although lacking in functionality).

Try exploring a reputable platform first. There is a solid reason why each of these platforms has established a reputation as industry standards. They not only have a very user-friendly design, but also a tonne of helpful features, such as Expert Advisors and VPSs that keep your EAs running even while your computer is off.

Trading conditions for Apex500

Although Apex500 was meant to provide us with enticing conditions, we were barely tempted. The minimum deposit is $250, which is not awful, but given that there are plenty of trustworthy brokers available today that will start an account for anywhere from $5 to $100, we advise against doing business with con artists. To be perfectly honest, the spreads were fairly terrible. The platform displayed a spread on the EURUSD pair starting at 3.5 pip, which is more than twice the industry average of 1.5 pip.

When it comes to leverage, things were a little more intriguing. A basic account has a leverage of 1:20, which is pretty reasonable and even less than the maximum 1:30 allowed in the EU and the UK. Thus, we were delighted by this. The image was spoiled when we learned that Apex500 offers leverage between 1:50 and 1:100 to clients who have deposited more money but do not meet the criteria for professional clients. Don’t let the excessive leverage that Apex500 offers seduce you. It does allow you to make larger bids and earn more money, but there is also a great likelihood that you will also lose a significant amount of money.

DEPOSIT/WITHDRAWAL METHODS AND FEES FOR Apex500

The standard Visa/MasterCard and bank transfer, as well as Qiwi Wallet and WebMoney, are the available deposit and withdrawal methods for us. We would not advise you to send any money to Apex500 con artists as they are scammers.

The offer of welcome bonuses, which range from 25% to 100% depending on the type of account, is another warning sign. You must first reach a turnover of 25 times your initial deposit plus the bonus in order to withdraw that bonus or any other cash from your account, including your own. Ignore these con artists at all costs since it is absurd for a broker to require that you attain a certain turnover in order to access your own money.

HOW DOES THE FRAUD OCCUR?

These frauds typically operate in the same manner. As you browse, a banner or advertisement for the con artist’s website promises you a huge profit. You, therefore, visit the website, decide it is appealing, and register because who wouldn’t want to make money so quickly and easily? And the con artists guarantee that they will quickly turn you into a seasoned trader. Your contact information will be obtained, and you will soon start receiving calls and emails requesting you to make a deposit. If you do, you’ll probably soon realise you’re generating a lot of money—a ruse designed to encourage you to make additional investments.

After some time, you’ve made some good money and are ready to withdraw. The con artists will now start inventing ridiculous justifications to put off that withdrawal, typically new taxes. The con artists will cease returning your calls as soon as you realise anything is amiss, which will happen eventually.

HOW TO RESPOND IF SCAMMED

Keep your cool and don’t believe any so-called “recovery agents” that promise to get your money back for a nominal cost. These are frequently the same con artists who duped you in the first place, and even if they are not, that is a totally separate fraud targeting vulnerable people. Upon receiving payment, your “recovery agent” will vanish.

Depending on your deposit method, you could request assistance from your Excellium Ltd (Excelliumltd.com). You have 540 days to file a chargeback with credit and debit cards. Don’t trust brokers who only accept cryptocurrency payments because they are non-refundable. However, since these issues are rarely addressed amicably, be ready for the worst. If you have validated your account, the con artists could revoke your claim on that pretext.

However, be sure to update any passwords or other sensitive information that scammers may have gotten their hands on. Inform the authorities and share the message online and among your friends. Many people can be rescued from the terrible circumstance they may have found themselves in.

Apex-500.com Details

The proprietor of Apex-500.com is N/A, and the website’s address is Suite 1, Second Floor, Sound&Vision House, Francis Rachel Str., Victoria, Mahe, Seychelles. They can be reached at support@apex-500.com or via phone at +442030974422. Visit their website at apex-500.com.

Traders’ Views

Doing extensive research on the businesses and organisations you intend to donate the monies to is the first step in defending yourself against shady individuals online like Apex500. There may probably already be other users of the service who have posted their comments and feedback online on various forums.

After doing some research on social media sites (such as Facebook, Twitter, and Instagram) and online trading forums, a common thread of people’s dissatisfaction with Apex500 developed. According to this user feedback, Apex500 does not seem to be a reliable broker, so extra caution should be exercised before making an investment using their brokerage platform.

There are many brokers out there who use fictitious company names or engage in other fraudulent activities. A little amount of prior investigation can go a long way toward safeguarding your finances and yourself.

Apex-500.com: Genuine or fraudulent?

Finding out about their certification should always be the first and most crucial step when looking for brokers to use for your trading operations (s). This will reveal whether Apex500 is an offshore and/or unregulated firm or if they are subject to centralised regulation.

When a broker is unregulated or is regulated by a body that is not in your country, you have little to no legal remedy if your money is stolen. If there is theft, complaints can only be filed if the broker has a licence from the regulatory body in your country. The following are a few instances of regulatory bodies that provide brokerage licences:

The Securities and Exchange Commission of Cyprus (CySEC)

Finance Conduct Authority (FCA)

Securities and Investments Commission of Australia (ASIC)

A broker should be avoided if they are unlicensed and cannot obtain a licence from the regulatory body in your country. Even if the brokerage is regulated, it is advised to stay away from it if the regulator is based somewhere else.

How Do Trading Scams Online Operate?

One of the most common online trading scams is showing positive trades at first to deceive investors into believing they will make money quickly. Following the development of this confidence, the investor will be persuaded to invest more money in order to receive higher returns. Other rewards might also be offered to entice investors to invite their friends and family to use the site.

The brokerage will proceed to suspend the account and prevent the investor from accessing the funds until they have taken all available cash from the investor and those in his or her network.

In an effort to gain the trust of unwary investors, many dishonest businesses may even assert that they are based in a regulated area and show fictitious regulatory licences and addresses on their websites.

Be cautious and check your information from several different sources. Sending money online should always be done with extreme caution.

Excellium Ltd (Excelliumltd.com) provides international financial fraud investigative measures aimed at helping victims of financial scams recover their money. Excellium Ltd (Excelliumltd.com) was founded to protect and help victims of investment scams with the assistance of sophisticated asset recovery specialists globally.

To recover your money from Apex500, consult the asset recovery experts at Excellium Ltd (Excelliumltd.com), with an excellent record in fund recovery, your case won’t be an exception. Contact Excellium Ltd (Excelliumltd.com) now.